If you’re unfamiliar with the topic of consensus mechanisms and want to learn, please watch Coin Bureau’s intro here.

If you want to learn about the problem that consensus mechanisms solve, please consider reading a short story here.

Proof-of-work versus proof-of-stake has been a long-running debate, and this article is primarily for some streamlining of my thoughts. Nevertheless, unless you’re an expert on consensus mechanisms and incentive systems, I believe that it’ll be a worthwhile read. It’s a far cry from the painfully simplistic and narrative-driven debate so often found on Twitter, plus I try to bring up some uncommon questions for both sides of the aisle.

Disclaimer: (1) I’ve omitted certain arguments in this article for brevity’s sake. (2) A follow-up article will come in the future, and my thoughts on many of the below points may change with time. (3) I write for Bitcoin Magazine, so I clearly like Bitcoin; I might unknowingly be biased.

Please roast me in the comments if you feel that I got something deeply wrong.

Nothing makes me cringe as much as hearing something like “POW is bad for the environment”, or “POS doesn’t make sense because it has no real-world anchor”.

I think that there’s enough nuance in both protocols for us to have some doubt over their efficacies, and we can all agree that straw-man arguments exist on both sides of the aisle.

Let’s dive right in.

On security

One of the most intriguing pro-POS arguments I’ve come across is that POS is SIMPLY MORE SECURE than POW. In his Nov 2020 post, Vitalik Buterin crunched out some numbers to illustrate why it’s easier to carry out a 51% attack on POW Bitcoin as opposed to POS Ethereum.

It’s noteworthy that the unit of measurement used is per dollar in block rewards per day, where an attack goes on for six hours.

Cost of attack on Bitcoin: $486.75

Cost of attack on Ethereum: $2189

Now, I deeply appreciate Vitalik for taking the effort to attempt to quantify this stuff. He further went on to explain how POS is good at deterring repeated attacks, and so on.

However, it’s important to note that these numbers objectively have significant room for error. For example, one of the precision issues with calculating in terms of block rewards is that the real-life value of the block rewards can vary quite significantly in those very same dollar terms. Extrapolating from the recent crypto crash, the cost of attacking Ethereum plummeted along with its market cap, whereas the cost of attacking Bitcoin didn’t—a drop in Bitcoin price was not followed by a drop in its hashrate. Calculating in terms of block rewards based on values at one specific point in time has its faults.

Now, I could just as easily throw out a counter that Vitalik’s talking about the future, where we assume that the price of Ethereum remains stable. But in that case, is it right to say that POW Bitcoin might exhibit higher security than POS Ethereum in the short-term, and that result might flippen in the long-term? It’s a question worth pondering.

Here are a couple more issues with the math:

1) Assuming that existing miners will be spending close to $1 in costs; this varies (and often varies counterintuitively). So he might be underestimating security derived from ASIC and GPU-based POW.

2) Assuming that ~15% rate of return is sufficient for decentralized staking. As we’ve seen, liquidity pools in POS systems and mining pools in POW Bitcoin have both raised concerns. Down the road, even Vitalik has acknowledged the staking pool centralization issue, which he didn’t mention in his Nov 2020 piece.

I find point two, which is related to centralization problems with mining and staking, rather interesting… because I don’t understand what all the fuss over it is about.

For example, Satoshi himself alluded to why concentration among miners isn’t really a problem:

If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favor him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

By this logic, raw concentration among stakers at any point in time shouldn’t be concerning, either. (It’s worth pointing out that this is something that some proponents of Bitcoin miss.)

Here’s one common Bitcoiner argument criticizing POS. Honestly, I was mind-blown the first time I read it:

Later, however, this tweet didn’t seem all that convincing: firstly, since mining is centralized and is usually carried out by centralized and registered companies, aren’t mining farms prone to regulation, too? And secondly, can’t decentralized liquidity pools mitigate this issue?

Yet, these are all microscopic questions; let’s move on to a big-picture one: how would regulation even force stakers/miners to act maliciously? As Satoshi said, it is explicitly and painfully against their self-interest.

Either way, I don’t find Vitalik’s “POS Ethereum boasts higher security than POW Bitcoin” argument very compelling. I concede: perhaps the math is precise and Ethereum boasts the superior security model, but why keep drilling on security when POW Bitcoin is already solid enough in this aspect? Shouldn’t we be arguing about other stuff once security becomes solid enough?

On efficiency

The next pro-POS argument surrounds ENERGY EFFICIENCY.

The first branch of this argument goes something like this: why waste so much energy on POW when POS does the same while using significantly less energy? Save the planet!

I really don’t want to spend too much time on this, but here’s the counterargument: it seems unintuitive, but POW’s increased energy usage is actually a net positive for the environment at the moment. Some points below:

There’s no prosperous human future in which we use less energy than we do today. So using energy consumption as pure justification for banning code is a straw man argument.

Bitcoin largely uses renewable/otherwise wasted energy. In cases like fracking, the fact that Bitcoin’s using this otherwise wasted energy is healthy for the environment.

Bitcoin and Ethereum are not identical protocols, so you cannot dismiss Bitcoin on the basis of energy usage alone. Depending on what you’re looking for, one may be superior (e.g. What do you want? Better money or better smart contract functionality?)

HOWEVER, here’s the second branch of the argument, which I find more compelling: if energy storage capabilities increase vastly down the road and POW ends up consuming less “wasted” or “renewable” energy, is the “POW is good for the environment” argument valid?

It’s worth pondering more about.

Zooming out

I want to touch on one of POW’s most compelling bigger-picture arguments, which I still believe that the POS community has not provided a compelling rebuttal towards:

CONCENTRATION OF WEALTH OVER TIME.

Both POS and POW demonstrate this concern, but POW to a much lesser degree.

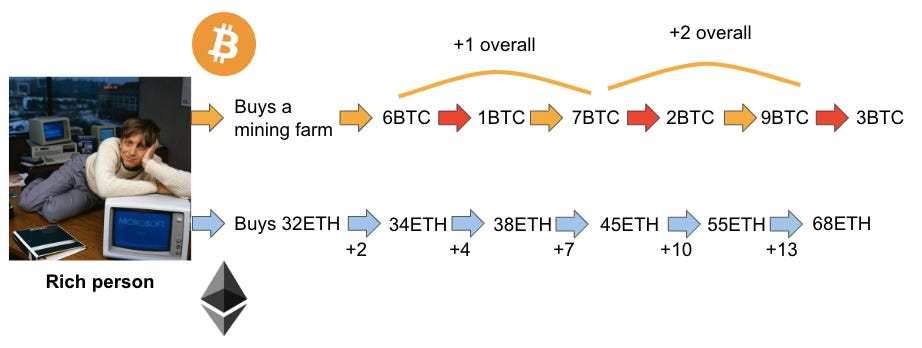

For example, Bill Gates would have a much easier time mining bitcoin or earning ether via staking compared to you or me. Because the initial capital advantage he has is beneficial in either system. However, the time taken to accumulate Bitcoin via mining is longer, since mining profits need to be reinvested into mining hardware and such.

If you can’t picture this process, the image below might help:

(Numbers are purely arbitrary. The red arrows represent how the revenue from mining needs to be reinvested in electricity. One arrow does not represent the rewards from a single block.)

I’d just like to briefly touch on the ramifications of such concentration on Web3, because it is core to what Ethereum is trying to build.

Layer 2s built on top of Ethereum often rely on on-chain governance, i.e. deciding the path of a protocol based on votes. Since votes are based on token ownership and tokens need to be bought, obviously, the already-rich have an advantage. My concern over POS is that with time, such supposedly decentralized L2s become individual plutocracies, since the rich are guaranteed to get richer faster via ETH staking. It could inhibit the move towards a decentralized internet.

That’s why in the wealth concentration arena, POS is especially concerning.

At this juncture, I hope that you can see a trend unraveling: POS folks tend to be more technically inclined, whereas POW proponents tend to be bigger-picture-centric. Both likely have their pros and cons, depending on what you’re trying to create.

Here’s a proposition to the POS folks out there though: estimate the probability of specific events happening (e.g. spawning attack) and thereby the utility gain from POS over POW (since there’s usually agreement that POS > POW security-wise in pro-POS communities). I’d be very interested in this, as would other pro-POW folks.

If you’re leaning completely towards POW, or completely towards POS, what I would say is: be a little less sure of yourself. You can have an opinion, and yes, there are folks out there with an established agenda to spread misinformation, but most of this stuff is still relatively new and unchartered.

Personally, I am glad that the merge happened. POW and POS are vastly different protocols, and thus, we can now watch crypto fulfil one of its very first promises:

To run large-scale experiments on different monetary systems.

You can also find me on Twitter @ramwithouthorns!